Traditionally, lenders have faced credit risk in the form of default by borrowers. To this date, credit risk remains major concern for lenders worldwide. The more they know about the creditworthiness of a potential borrower, the greater the chance they can maximize profits, increase market share, minimize risk, and reduce the financial provision that must be made for bad debt. This product provides fundamental understanding of the credit risk analysis process and discusses in detail, various aspects of financial statement analysis, including ratio and cash flow analysis, among others to help in making better credit-related decisions. It also looks at various non-financial factors such as Business Plan, Industry/Sector, Top Management, etc. that could affect the creditworthiness.

Objectives:

After completing this course you will be conversant with:

- Apply credit analysis to assess borrowers in real cases

- Perform ratio analysis and cash flow analysis

- Structure loan products in a competitive way

- Identify and work-out problem loans

Who should attend?

Every professional involved in the global financial services industry (as a provider, user, regulator or advisor of product/services, marketplace/exchange) would benefit from KESDEE’s innovative solutions:

- Supervisory Agencies

- Central Banks

- Financial Institutions

- Commercial Banks

- Investment Banks

- Housing Societies/Thrifts

- Mutual Funds

- Brokerage Houses

- Stock Exchanges

- Derivatives Exchanges

- Insurance Companies

- Multinational Corporations

- Accountancy Firms

- Consultancy Firms

- Law Firms

- Rating Agencies

- Multi-lateral Financial Institutions

- Others

Course Outline:

Overview of Credit Analysis:

- Objectives

- Credit Risk

- Credit Analysis

- Seven C’s

- Credit Analysis Process

Lending Process:

- Objectives

- Introduction

- Credit Process

- Documentation

- Loan Pricing and Profitability Analysis

- Regulations

Financial Statement Analysis-I:

- Objectives

- Introduction

- Ratio Analysis

- Liquidity Ratios

- Turnover Ratios

- Profitability Ratios

- Leverage Ratios

- Market Ratios

Financial Statement Analysis-II:

- Objectives

- Introduction

- Elements of Cash Flow Statement

- Direct Method

- Indirect Method

- Interpreting Cash Flows

Non-Financial Analysis:

- Objectives

- Non financial analysis

- Economy analysis

- Industry analysis

- Business analysis

Asset Classification and Loan Loss Provisioning:

- Objectives

- Asset Quality

- Quantitative and Qualitative Review

- Asset Classification

- Special Mention Asset

- Loan Loss Provisioning

Borrowing Causes and Sources of Repayment:

- Objectives

- Introduction

- Operating Cycle

- Capital Investment Cycle

- Sources of Repayment

Problem Loans:

- Objectives

- Introduction

- Asset Management Companies

- Securitization of NPLs

- Debt Restructuring

- Preventing Problem Loans

Consumer Installment Lending:

- Types and characteristics of consumer installment lending

- Various types of Installment loans

- Dealer Agreement, Recourse and Dealer Reserve

- Common risks faced in consumer installment lending

Floor Plan Lending:

- Characteristics of Floor Plan Lending

- Methods of Floor Plan Lending

- Risks Associated with Floor Plan Lending

Accounts Receivable and Inventory Lending:

- Concept of Accounts receivable and inventory based lending

- Risks faced in Accounts Receivable and Inventory Based Lending

Participation Loan:

- Concept of Loan participation

- Need for Loan participation

- Process of Loan participation

- Risks faced in Loan participation

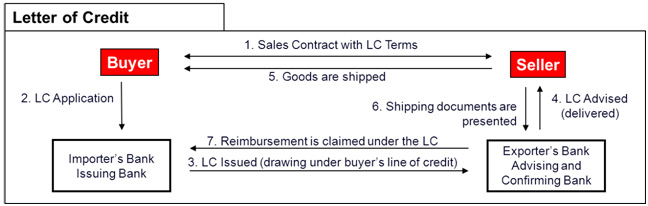

Letter of Credit and Loan Commitments:

- Concept of Letter of Credit (LC)

- Types of Letter of Credit

- Risks faced in Letter of Credit

- Loan commitments, Un-funded lines of credit and their characteristics

- Potential credit risk in loan commitments and un-funded lines of credit

WORKSHOP STYLE:

The workshop will be of five day’s duration consisting of interactive learning sessions, videos, examples and role-play exercises to provide the delegates with the knowledge and experience of using the key learning issues and techniques.