Course objectives:

The specific objects of this course will be to give participants:

- A comprehensive understanding of the role of budgeting in the planning and control process of the business,

- A working familiarity with the foundation building blocks required prior to preparing the budget,

- A detailed understanding and familiarity with the techniques of budgeting for income, expenses, cash flow, profit & loss and balance sheet.

- A working knowledge of the techniques of analyzing variances between actual results and budgets, including sales volume, price and mix variances; labour variances; material quantity and price variances; overhead variances.

- A comprehensive understanding of the forms and procedures involved in the budgeting process

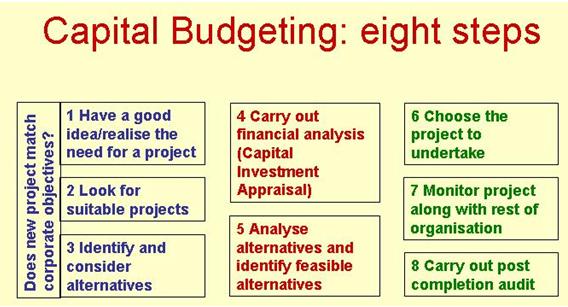

- An introduction to the subjects of budget modeling and capital budgeting.

Who should attend?

All workers in the accounting and finance departments and follow-up projects.

Course Outline :

This course on Budget Preparation Techniques will examine:

- Advantages of budgeting and budgetary control;

- The concept of control;

- Elements of a control system;

- Setting the goals and objectives to be achieved;

- Types of budgets prepared;

- Setting the budget assumptions;

- Zero based budgeting;

- Budget preparation, review and approval process;

- Operating budgets and capital budgets

- Monitoring actual performance;

- Budget variance analysis and comparing actual with budget;

- Flexible budgeting

- Risk analysis and project evaluation:

- Payback Period

- Net Present Value ( NPV )

- Internal Rate of Return. ( IRR)

WORKSHOP STYLE:

A mixture of short presentations, interactive discussion, individual exercises and group work. The emphasis throughout is on a practical approach using case material and examples.