Objectives:

By the end of the course, participants will be able to:

- Understanding the scope of the audit planning process

- Techniques for organizational risk assessment

- Appreciating how audit planning impacts audit sampling

- Understanding the relationship between materiality and audit sampling

- Techniques to select audit samples for balance sheet and income statement

- Define internal audit, its scope and function within the company

- List the internal audit standards constituting the framework of the internal audit activity

- Distinguish the types of internal audit assignments related to operational, compliance or financial internal audit

- Describe the internal audit fieldwork guidelines and apply techniques for risk identification, controls identification and controls testing

- Select the appropriate internal audit test tools and list the advantages and disadvantages of each

- Identify best sampling techniques in an internal audit assignment in terms of sample size or sample selection

- Recognize fraud and express internal auditor’s responsibility upon fraud detection

Course Outline:

Internal Audit Standards:

- Attribute standards

- Performance standards

Types of Internal Auditing:

- Performance auditing

- Operational auditing

- Financial auditing: accounting cycles audited by the internal audit function

- Compliance auditing

- 20 questions directors should ask about the internal audit function

Audit Pre-Engagement Planning:

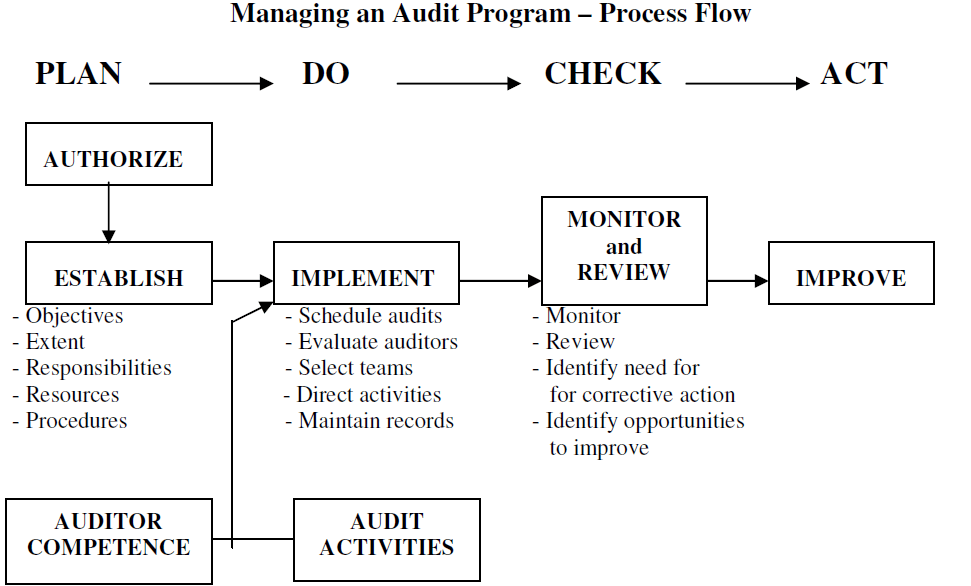

- Overview of audit process

- How pre-engagement planning impact substantive testing

- Engagement evaluation

- Engagement letter

- Discussions with those charged with governance

- Types and volumes of transactions

- Preliminary analytical review

- Review of prior year management report

- Understanding the entity and its environment

Audit Planning at Engagement Level:

- Planning and risk assessment

- Risk assessment at assertion level

- Inherent risk assessment

- Accounting records

- Journal entries environment

- Commitments and contingencies

- Concept of materiality

- Materiality calculation

- Principles of substantive testing

Audit Sampling: Assets:

- Applicable audit assertions

- Applicable international standards on auditing (ISA’s)

- Property, plant and equipment

- Intangible assets

- Group companies

- Investments

- Inventories

- Trade receivables

- Cash and equivalents

Audit Sampling: Capital and Liabilities:

- Applicable audit assertions

- Capital and reserves

- Financial liabilities

- Related parties

- Trade payables

- Provisions and Accruals

- Other (i.e. group identified needs)

Audit Sampling: Income Statement:

- Applicable audit assertions

- Revenue

- Contracts

- Cost of sales

- Other income

- Employee costs

- Operational expenses

- Finance costs

- Common mistakes

- Best practices

Audit Methodology:

- Audit methodology according to individual phases and areas

- “Project initiation” phase

- The “Project proposal” phase

- The “Project planning” phase

- The “Project realisation” phase

- The “Project completion” phase

- Behavioural competence

- Overall evaluation

- Basic audit structure

- Audit of procurement process

- Audit of engagement with contractors

Audit Implementation and Reporting:

- Practical implementation of the audit process

- Common issues of the process

- Ethical considerations

- Dealing with stakeholders

- Application of resources

- Writing the audit report

- Audit report content

- Presenting / implementing audit report

- Implementation of best practices

WORKSHOP STYLE:

A mixture of short presentations, interactive discussion, individual exercises and group work. The emphasis throughout is on a practical approach using case material and examples.